are union dues tax deductible in 2020

Miscellaneous itemized deductions are those deductions that would have. You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund.

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

That would be fun to explain to a programmer.

. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021 DAngeloMutter asking whether legislative changes made in Albertas Bill 32. Dues arent deducted until the worker signs paperwork that authorizes dues deduction and elects membership or fee paying status. Elected officials of the union set union dues and typically hover around 1-2.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. I just did a return with Housing Allowance listed there. And yes the clergy do have unions in Great Britain and Canada.

31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. To enter your union dues for work performed as an employee W-2. Job-related expenses arent fully deductible as they are subject to the 2 rule.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions. Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense. Restoring Balance in Albertas Workplaces Act 2020 Bill 32 relating to annual union dues will have implications on the.

A reminder for tax season. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. If youre self-employed you can deduct union dues as a business expense.

That is the deductibility has been suspended for tax years 2018 through 2025 inclusive. There are however a few. Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. You can deduct dues and initiation fees you pay for union membership. At the beginning of every year employers must issue their employees a T4.

You can also claim up to 42 per income year for the cost of each subscription you incur for membership of a trade business or professional association where its not in direct relation to earning your employment income. Line 21200 was line 212 before tax year 2019. Under current federal law employee business expenses are generally not deductible.

Union Dues or Professional Membership Dues You Cannot Claim. The Joint Committee on. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions.

From within your TaxAct return Online or Desktop click on the Federal tab. Educator expense tax deduction renewed for 2020 tax returns. The deduction would last through 2025.

You can claim a deduction. What are typical union dues. SOLVEDby TurboTax8006Updated December 22 2021.

Early 2020 reports cited an average 38 salary increase in first contracts. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too. Professional board dues required under provincial or territorial law. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing.

This Statement of Remuneration Paid shows employment income and tax deducted during the previous year as well as several other items. An employee business expense is generally defined as an expense paid by the employee for the purpose of carrying on a job with their employer or a business. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement.

Box 44 of this slip reports union dues paid. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. Deduction of union dues.

This prohibition was written into the tax reform legislation passed by the US. Annual dues for membership in a trade union or an association of public servants. Most unions and associations send their members a statement of the fees or subscriptions they pay.

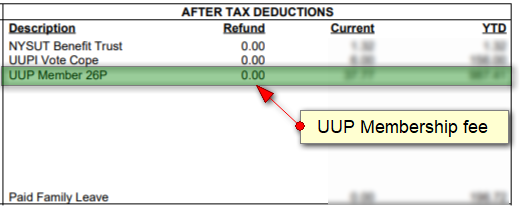

During the year ending Dec. On smaller devices click the menu icon in the upper left-hand corner. Federal law allows unions and employers to enter.

If you and your spouse are filing jointly and. The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues equivalents as a condition of employment. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

To enter union dues in TaxAct. To claim this expense report this amount on line 212 of your income tax return. In other words union dues would get the same treatment now reserved for things like insurance premiums and retirement contributions.

If you are self-employed you can enter your union dues as a Schedule C business expense. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions. Union dues may be tax deductible subject to certain limitations.

However you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of wages from unemployment caused by business conditions. Furthermore you cannot claim a tax deduction. We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT.

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Union Fees Are They Tax Deductible And What Are They Pop Business

Deducting Union Dues Drake17 And Prior

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Unreimbursed Employee Expenses What Can Be Deducted Freshbooks

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Different Types Of Payroll Deductions Gusto

Ibew New Bill Would Restore Tax Deduction For Union Dues Cinemontage

A Tax Break For Union Dues Wsj

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Solved Where Do I Enter New York State Teacher Union Dues For Nys Taxes

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Union Payroll 101 Taxes And Fringes Union Dues Vacation Fund Fca International